Swing traders working with prop firms typically hold positions for several days to a few weeks, aiming to capture larger price movements within a broader market trend. They focus on technical analysis, chart patterns, and sometimes fundamental catalysts to identify entry and exit points. While they trade less frequently than scalpers, swing traders aim for higher returns per trade by riding medium-term trends.

Unlike other trading strategies (e.g., intraday trading or scalping), swing trading usually requires patience and a strong understanding of market cycles, as positions are exposed to overnight and weekend risk. However, it generally involves lower leverage and fewer trades, which can make it more manageable for traders who prefer a less intense pace.

- Chart Timeframes: H4 – D1 – W1

- Trades last overnight, sometimes up to several weeks

- You aim to capture larger market trends

- Lower trade frequency but higher reward-to-risk ratio

- You need patience to endure unprofitable days, or sideways market movement

- Swap rates may apply (overnight holding fees) & Weekend holding fees

- Some traders find it stressful to leave positions open. If that’s you, lower your risk amount, set price alerts, use stop losses, and trust your analysis

- Recommended for beginners and part-time traders who prefer slower paced prop trading

Prop Firm Rules for Swing Trading:

Overnight & Weekend Holding Rule

- Choose a prop firm that allows holding positions overnight and over the weekend without extra fees or restrictions

Leverage & Lot Size

- Avoid firms with leverage lower than 1:5 – it limits your ability to manage multiple trades

- Aim for firms offering at least 1:10 to 1:30 leverage to maintain flexibility and optimize trade sizing

Maximum Drawdown

- Look for a higher max drawdown allowance (preferably 10–12%)

List of the Best Prop Firms for Swing Traders:

Monevis Funding

| Pro’s | Con’s |

|---|---|

| ✔ Swap free Accounts | – |

| ✔ Medium to high leverage trading (1:50) | – |

| ✔ Allow weekend holding without restrictions | – |

| ✔ Offers higher max drawdown (10% on 2-step accounts) | – |

Find the Highest Discount for Monevis

Fintokei

| Pro’s | Con’s |

|---|---|

| ✔ Offers higher leverage trading (1:100) | ✘ Does not offer swap free accounts (fees apply) |

| ✔ Allow weekend holding (swap fees are applied) | – |

| ✔ Offers higher max drawdown (10% on all account types) | – |

Find the Highest Discount for Fintokei

Quant Tekel

| Pro’s | Con’s |

|---|---|

| ✔ Offers higher leverage trading (1:100) | ✘ Does not offer swap free accounts (fees apply) |

| ✔ Allow weekend holding (but triple swap fees are applied) | ✘ Does not offer higher max drawdown:

– 1 step account max drawdown: 6% |

Find the Highest Discount for Quant Tekel

Pipfarm

| Pro’s | Con’s |

|---|---|

| ✔ Offers higher leverage trading (1:100) | ✘ Does not offer higher max drawdown:

– 1 Step Challenge (Maximum Drawdown): 5% Trailing |

| ✔ Allow weekend holding without restrictions | – |

| ✔ Swap free accounts (for an additional 15% fee) | – |

Find the Highest Discount for PipFarm

Funded Trading Plus

| Pro’s | Con’s |

|---|---|

| ✔ Medium leverage trading (1:30) | ✘ Does not offer swap free accounts (fees apply) |

| ✔ Allow weekend holding without restrictions | – |

| ✔ Offers higher max drawdown – 2-Step Advanced Trader (Maximum Drawdown): 10% – 2-Step Premium Trader (Maximum Drawdown): 8% |

– |

Find the Highest Discount for Funded Trading Plus

Funding Traders

| Pro’s | Con’s |

|---|---|

| ✔ Swap free accounts | ✘ Does not offer higher max drawdown

– 1 Step Challenge (Maximum Drawdown): 5% Trailing |

| ✔ High leverage trading (1:100) | – |

| ✔ Allow weekend holding without restrictions | – |

Find the Highest Discount for Funding Traders

Advice for Swing Traders

Now that you know what prop firm conditions to look out for and how to trade like a swing trader, here are a few things you should do to improve your swing trading game:

Choose one setup. Here’s an example using a trend continuation:

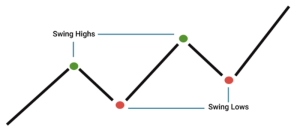

- Focus on higher timeframes (1-hour, 4-hour, or daily charts)

- Identify a clear trend using moving averages or trendlines

- Wait for a pullback to a support or resistance zone (e.g., previous breakout level or moving average)

- Enter when price confirms the bounce with a strong candlestick pattern (e.g., pin bar, bullish engulfing)

Ready to start swing trading? Explore the industry’s most reliable firms and access exclusive discounts with Propvator.com

Got questions about prop firms or anything else? Reach out to us by clicking the livechat icon and we’d be happy to answer any questions.

Find the Best Prop Firm Offers