In May 2017, FTMO introduced one of the first prop firm trading programs.

At the time, prop firms were a niche concept, barely registering on most traders’ radars.

Traditional brokers dominated the market, offering familiar platforms for retail trading.

Prop firms, with their promise of funded accounts, were largely unknown.

A Surge in Popularity

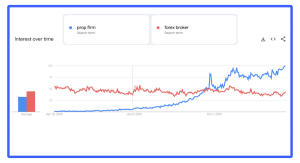

Things began to change around July 2020. Google Trends data shows a noticeable uptick in searches for prop firms.

From 2020 to the summer of 2023, their popularity skyrocketed, eventually surpassing brokers in global search interest.

The appeal was clear: prop firms allowed traders to access large capital without risking personal savings.

Profit splits, often as high as 90%, made them even more attractive.

Meanwhile, brokers maintained steady but stagnant search interest, unable to match the buzz around prop firms.

The Prop Firm Boom

Since July 2023, the industry has continued to grow.

New firms have launched, each offering distinct account types and trading conditions.

For example, FTMO provides up to $400,000 in virtual capital, while The Funding Traders offer commission free trading, suitable for scalpers.

This week, prop firms reached a peak in worldwide Google searches, marking their highest popularity to date.

According to industry data, prop trading grew by 1,264% from December 2015 to April 2024, compared to just 240% growth for traditional investing in the same period.

Reliability Challenges

Not every prop firm has delivered on its promises. Some have faced criticism for unreliable payouts, unclear rules, or questionable practices.

These issues have sparked a recent shift. Google Trends indicates a slight decline in prop firm searches, while interest in brokers is starting to rebound.

Traders frustrated by unreliable firms are returning to brokers, which offer greater regulation and stability.

With brokers, client funds are often segregated, and risks are more transparent, making them a safer choice for cautious traders.

Navigating the Prop Firm Landscape

Prop firms can be a game-changer for traders, but choosing a reliable one is essential.

Reputable firms like FTMO, with a 4.8/5 rating from nearly 6,000 Trustpilot reviews, or Fintokei, scoring 4.8/5, prioritize transparency.

Traders should look for clear rules, fair trading conditions, and high profit splits.

Firms with well-defined risk management policies provide peace of mind, ensuring traders can focus on their strategies without worrying about hidden catches.

Looking Ahead

Prop firms are reshaping the trading world, and their popularity shows no signs of slowing.

However, their long-term success hinges on reliability. As traders become more discerning, only the most transparent and trustworthy firms will thrive.

Brokers, with their regulated platforms, remain a stable alternative, especially for those burned by subpar prop firms.

The Google Trends data tells a dynamic story, one of rapid growth, emerging challenges, and an ongoing battle for traders’ trust.

Propvator: Prop Firm Discounts and Comparison

Looking to save on prop firm trading? Check Propvator.com to find exclusive discounts and compare top prop firms to match your trading style.

Sources: Prop Trading Statistics 2025, FTMO Official Website, Benzinga: 7 Best Prop Trading Firms in 2025, Fortunly: Best Prop Trading Firms in April 2025, Google Trends