Scalpers trading with a prop firm typically execute dozens, even hundreds of trades per day, aiming to generate consistent profits from incremental price shifts.

They not only capitalise on short-term price action but also seek to profit from the bid-ask spread. To do this effectively, many scalpers employ automated strategies or advanced trading software provided or supported by the prop firm.

Unlike other trading strategies (e.g. day trading or swing trading), scalping usually requires more trading experience because the trader uses higher leverage which may cause financial harm if not managed properly.

- Chart timeframes: M1 – M5

- Trades last seconds to a few minutes

- Requires focus, rapid trade execution, and lots of screen time

- Objective: capitalize on minimal price movements with high frequency

- Works best during high-volatility hours (like EU and US session opens)

- Avoid Low-volume hours (Asia session, unless you’re trading yen pairs)

Why Prop Firms Ban HFT

The rise of high-frequency trading (HFT) has intensified competition for scalpers, with algorithms scanning thousands of securities and exploiting price inefficiencies in milliseconds.

While HFT offers advantages, most reputable prop firms prohibit its use.

True HFT requires expensive infrastructure and ultra-low latency connections, which are impractical for most traders. It can also conflict with firm policies due to the potential for excessive order flow, regulatory concerns, and system disruption.

As a result, prop firms typically prefer manual or semi-automated scalping strategies that align with their risk management standards. So in short, you can consider it a green-flag when you see a prop trading firm prohibit the use of HFT.

Prop Firm Rules for Scalpers:

High Leverage Trading

If you’re a Scalper, you should go for a prop firm challenge that offers high leverage trading between (1:50 and 1:100)

Avoid Those Two Prop Firm Restrictions

Next, you want to make sure to avoid prop firms that have restrictions on:

- Minimum trade duration

- News trading

Commission Fees

Lastly, look for prop firms that have low commission or no commission at all because the small numbers will add up as you take multiple trades.

List of the Best Prop Firms for Scalpers:

Funding Traders

| Pro’s | Con’s |

|---|---|

| ✔ Allows News trading | ✘ HFT not allowed |

| ✔ Commission Free trading | – |

| ✔ High Leverage trading (1:100) | – |

| ✔ No Minimum Trade Duration on $5k – $100k accounts | – |

Find the Highest Discount for Funding Traders

Monevis Funding

| Pro’s | Con’s |

|---|---|

| ✔ Allows News trading | ✘ HFT not allowed |

| ✔ Medium – High Leverage trading (1:50) | ✘ Commission are applied |

| ✔ No Minimum Trade Duration on all accounts | – |

Find the Highest Discount for Monevis

Pipfarm

| Pro’s | Con’s |

|---|---|

| ✔ Allows News Trading | ✘ HFT not allowed |

| ✔ Commission Free Trading | – |

| ✔ High Leverage Trading (1:100) | – |

| ✔ No Minimum Trade Duration on all accounts | – |

Find the Highest Discount for PipFarm

Quant Tekel

| Pro’s | Con’s |

|---|---|

| ✔Allows News Trading | ✘ HFT not allowed |

| ✔High Leverage trading (1:100) | ✘ News Trading not allowed |

| – | ✘ Commission are applied ($4 per round lot) |

Find the Highest Discount for Quant Tekel

Fintokei

Pros:

✔High Leverage trading (1:100)

✔Allows News Trading

Cons:

✘ Does not offer Swap Free Accounts

✘ Commissions are applied ($6 per round lot)

✘ HFT not allowed

| Pro’s | Con’s |

|---|---|

| ✔Allows News Trading | ✘ HFT not allowed |

| ✔High Leverage trading (1:100) | ✘ Does not offer Swap Free Accounts |

| – | ✘ Commissions are applied ($6 per round lot) |

Find the Highest Discount for Fintokei

Advise for Scalpers

Now that you know what prop firm conditions to look out for and how to trade like a scalper, here are a few things you should do to improve your scalping game:

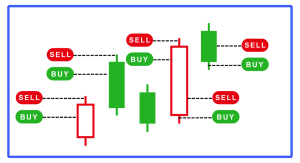

Choose one setup. Here’s an example using a momentum pullback:

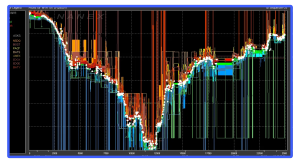

- Trade only during high-volume sessions (London open, NY open)

- Identify a strong directional move (momentum candle with volume, 5-min chart)

- Wait for a pullback to a key level (e.g. 50% Fibonacci retracement level)

- Enter when price rejects the level with a wick or engulfing candle (confirm with 1-min chart)

Ready to start scalping? Explore the industry’s most reliable firms and access exclusive discount with Propvator.com

Got questions about prop firms or anything else? Reach out to us by clicking the livechat icon and we’d be happy to answer any questions.

Find the Best Prop Firm Deals