One of the biggest mistakes new traders make is trading with a position size that’s too large for their account a.k.a. over-leveraging. This often leads to blowing up accounts, especially when emotions kick in.

Every responsible trader knows their maximum lot size before they enter a trade. By doing so, they ensure they don’t exceed their risk tolerance or margin availability.

This article will walk you through exactly how to calculate your max lot size, step by step, with practical examples and tips to keep your trading risk under control.

Why Lot Size Matters

Lot size directly affects your profits and your losses.

- A small lot size means smaller potential gains, but also smaller risks.

- A large lot size can magnify profits, but one bad trade could wipe out weeks (or months) of progress.

By calculating your maximum lot size correctly, you:

- Protect your trading capital.

- Trade consistently without emotional decisions.

- Stay within prop firm or broker risk rules.

- Avoid margin calls or unnecessary account liquidation.

What You’ll Need Before Calculating Lot Size:

To calculate your maximum lot size, you’ll need a few key pieces of information:

- Account Balance: Your starting capital or account size.

- Risk % (Risk per Trade): How much of your account you’re willing to risk. The standard is 1–2% per trade.

- Stop Loss (in pips): The distance from your entry to your stop loss. This comes from your strategy or analysis.

- Pip Value: How much one pip is worth for a given lot size on the currency pair you’re trading.

Step-by-Step Guide: Calculating Lot Size

Step 1: Choose how much to risk per trade

- Standard is 1-2% of your account.

- Example: Account = $5,000, Risk = 2% → You’re risking $100 per trade.

Step 2: Determine your stop loss (in pips)

- Based on your strategy or technical analysis.

- Example: Stop loss = 50 pips

Step 3: Find the pip value per lot

For most USD-based pairs:

-

- 1 standard lot (100,000 units) = $10/pip

- 1 mini lot (10,000 units) = $1/pip

- 1 micro lot (1,000 units) = $0.10/pip

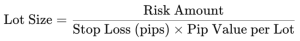

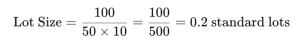

Step 4: Use the formula to calculate lot size

Example Calculation

- Account balance: $5,000

- Risk Amount: 2% → $100

- Stop loss: 50 pips

- Pip value per standard lot: $10

So you can trade 0.2 lots on this position safely.

Common Mistakes When Calculating Lot Size

- Ignoring Leverage and Margin Requirements: Even if your lot size calculation is correct, your broker’s leverage may limit your ability to open large positions.

- Risking More Than 2% Per Trade: Over time, even a strong strategy can’t survive poor risk management.

- Not Adjusting for Volatility: Pairs like GBP/JPY or Gold (XAU/USD) are more volatile, sometimes requiring wider stops and smaller lot sizes.

- Forgetting Commission/Spread: High spreads or commissions can eat into risk tolerance.

Tools to Help You Calculate Lot Size

If math isn’t your thing, you don’t need to worry. There are tools that do the work for you:

- Online Lot Size Calculators (many brokers and prop trading firms offer free tools)

- TradingView Scripts/Indicators that auto-calculate lot size.

- MT4/MT5 Expert Advisors that adjust lot size based on account equity and stop loss.

But remember: even with tools, you need to understand the logic behind the numbers.

Advanced Considerations

For experienced traders, lot size isn’t always just about stop loss × pip value. Some factors to consider:

- Different Asset Classes: Indices, commodities, and crypto pairs have different contract sizes.

- Variable Pip Values: For non-USD account currencies, pip values change depending on the pair.

- Scaling In/Out: Advanced traders split trades into smaller entries and exits, which changes risk calculations.

FAQ’s About Lot Size and Risk Management

Q1: What’s the safest risk percentage per trade?

Most traders use 1% per trade. Aggressive traders may use 2%, but anything higher is considered risky.

Q2: What happens if I use the wrong lot size?

If you trade too large, you risk blowing your account quickly. Too small, and your account may grow too slowly.

Q3: Do prop firms care about my lot size?

Yes. Many prop firms enforce maximum lot size rules to prevent reckless trading. Always check the firm’s guidelines.

Q4: Does leverage affect lot size?

Yes. Higher leverage allows you to open bigger positions with less margin, but it doesn’t change your risk per trade calculation.

Q5: Should I always use the same lot size?

No. Lot size should adapt based on your stop loss and account size. Two trades with different setups may require different lot sizes.

Q6: Can I calculate lot size for Gold or Indices the same way?

The principle is the same, but pip values and contract sizes differ. Always check your broker’s contract specifications.

Q7: How does drawdown affect lot size decisions?

Drawdown is the total reduction of your account from peak to trough. If your lot size is too big, a series of losses can quickly push you into maximum drawdown, especially under prop firm rules. Always size trades so that several consecutive losses won’t exceed your allowed drawdown.

Final Thoughts

Knowing how to calculate your maximum lot size is one of the most important trading skills you’ll ever learn. It protects your capital, keeps your emotions in check, and ensures long-term consistency.

If you’re new to trading, practice this calculation every time before placing a trade until it becomes second nature. And if numbers overwhelm you, use a lot size calculator, but make sure you understand the logic.

At Propvator, we help traders not only learn risk management but also compare the best prop firm offers so you can trade smarter and safer.